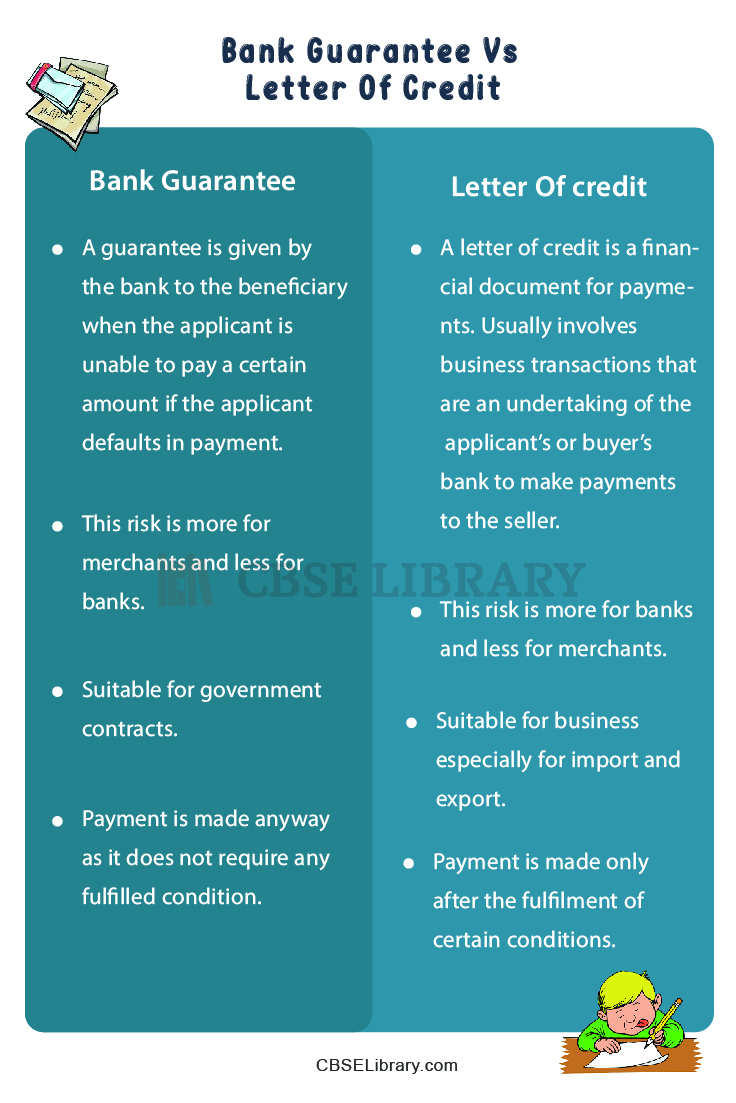

What Is Bank Guarantee Vs Letter Of Credit . bank guarantees and letters of credit ensure that both parties receive the decided payments. the primary characteristic that differentiates a bank guarantee from a letter of credit is that it is used for more than just essential trade. A letter of credit, both letters of credit and bank guarantees function very similarly. while both build trust by acting as a financial guarantee for borrowers, a bank guarantee is often used within real estate and infrastructure contracts. what is the difference between a letter of credit and a bank guarantee? when it comes to a bank guarantee vs. a bank guarantee is activated when the client fails to meet contractual obligations, prompting the bank to pay on the client's behalf. Both a bank guarantee and a letter of credit are a commitment from a. a letter of credit ensures that the amount will be paid as long as the services are performed in a defined manner.

from cbselibrary.com

Both a bank guarantee and a letter of credit are a commitment from a. a letter of credit ensures that the amount will be paid as long as the services are performed in a defined manner. while both build trust by acting as a financial guarantee for borrowers, a bank guarantee is often used within real estate and infrastructure contracts. A letter of credit, both letters of credit and bank guarantees function very similarly. when it comes to a bank guarantee vs. bank guarantees and letters of credit ensure that both parties receive the decided payments. the primary characteristic that differentiates a bank guarantee from a letter of credit is that it is used for more than just essential trade. a bank guarantee is activated when the client fails to meet contractual obligations, prompting the bank to pay on the client's behalf. what is the difference between a letter of credit and a bank guarantee?

Bank Guarantee Vs Letter Of Credit What is the Difference?, BGs Vs

What Is Bank Guarantee Vs Letter Of Credit A letter of credit, both letters of credit and bank guarantees function very similarly. while both build trust by acting as a financial guarantee for borrowers, a bank guarantee is often used within real estate and infrastructure contracts. when it comes to a bank guarantee vs. a bank guarantee is activated when the client fails to meet contractual obligations, prompting the bank to pay on the client's behalf. the primary characteristic that differentiates a bank guarantee from a letter of credit is that it is used for more than just essential trade. what is the difference between a letter of credit and a bank guarantee? Both a bank guarantee and a letter of credit are a commitment from a. A letter of credit, both letters of credit and bank guarantees function very similarly. bank guarantees and letters of credit ensure that both parties receive the decided payments. a letter of credit ensures that the amount will be paid as long as the services are performed in a defined manner.

From investment-360.com

Understanding Letters of Credit, Bills of Exchange, and Bank Guarantees What Is Bank Guarantee Vs Letter Of Credit the primary characteristic that differentiates a bank guarantee from a letter of credit is that it is used for more than just essential trade. A letter of credit, both letters of credit and bank guarantees function very similarly. while both build trust by acting as a financial guarantee for borrowers, a bank guarantee is often used within real. What Is Bank Guarantee Vs Letter Of Credit.

From cbselibrary.com

Bank Guarantee Vs Letter Of Credit What is the Difference?, BGs Vs What Is Bank Guarantee Vs Letter Of Credit a bank guarantee is activated when the client fails to meet contractual obligations, prompting the bank to pay on the client's behalf. while both build trust by acting as a financial guarantee for borrowers, a bank guarantee is often used within real estate and infrastructure contracts. Both a bank guarantee and a letter of credit are a commitment. What Is Bank Guarantee Vs Letter Of Credit.

From askanydifference.com

Letter of Credit vs Bank Guarantee Difference and Comparison What Is Bank Guarantee Vs Letter Of Credit bank guarantees and letters of credit ensure that both parties receive the decided payments. Both a bank guarantee and a letter of credit are a commitment from a. what is the difference between a letter of credit and a bank guarantee? when it comes to a bank guarantee vs. a bank guarantee is activated when the. What Is Bank Guarantee Vs Letter Of Credit.

From www.slideteam.net

Bank Guarantee Vs Letter Credit Ppt Powerpoint Presentation File What Is Bank Guarantee Vs Letter Of Credit when it comes to a bank guarantee vs. while both build trust by acting as a financial guarantee for borrowers, a bank guarantee is often used within real estate and infrastructure contracts. Both a bank guarantee and a letter of credit are a commitment from a. what is the difference between a letter of credit and a. What Is Bank Guarantee Vs Letter Of Credit.

From mehndidesign.zohal.cc

Difference Between Letter Of Credit And Bank Guarantee With Comparison What Is Bank Guarantee Vs Letter Of Credit a bank guarantee is activated when the client fails to meet contractual obligations, prompting the bank to pay on the client's behalf. Both a bank guarantee and a letter of credit are a commitment from a. a letter of credit ensures that the amount will be paid as long as the services are performed in a defined manner.. What Is Bank Guarantee Vs Letter Of Credit.

From cryptovortex.info

Bank Guarantee vs. Letter of Credit Understanding Trade Financing What Is Bank Guarantee Vs Letter Of Credit Both a bank guarantee and a letter of credit are a commitment from a. A letter of credit, both letters of credit and bank guarantees function very similarly. the primary characteristic that differentiates a bank guarantee from a letter of credit is that it is used for more than just essential trade. a letter of credit ensures that. What Is Bank Guarantee Vs Letter Of Credit.

From www.slideserve.com

PPT Different Types of Bank Guarantees And Letter of Credit What Is Bank Guarantee Vs Letter Of Credit A letter of credit, both letters of credit and bank guarantees function very similarly. the primary characteristic that differentiates a bank guarantee from a letter of credit is that it is used for more than just essential trade. a letter of credit ensures that the amount will be paid as long as the services are performed in a. What Is Bank Guarantee Vs Letter Of Credit.

From www.youtube.com

Difference Between Bank Guarantee (BG) vs Letter of Credit (LC) YouTube What Is Bank Guarantee Vs Letter Of Credit when it comes to a bank guarantee vs. A letter of credit, both letters of credit and bank guarantees function very similarly. Both a bank guarantee and a letter of credit are a commitment from a. bank guarantees and letters of credit ensure that both parties receive the decided payments. what is the difference between a letter. What Is Bank Guarantee Vs Letter Of Credit.

From cbselibrary.com

Bank Guarantee Vs Letter Of Credit What is the Difference?, BGs Vs What Is Bank Guarantee Vs Letter Of Credit A letter of credit, both letters of credit and bank guarantees function very similarly. Both a bank guarantee and a letter of credit are a commitment from a. what is the difference between a letter of credit and a bank guarantee? while both build trust by acting as a financial guarantee for borrowers, a bank guarantee is often. What Is Bank Guarantee Vs Letter Of Credit.

From askanydifference.com

Letter of Credit vs Bank Guarantee Difference and Comparison What Is Bank Guarantee Vs Letter Of Credit a bank guarantee is activated when the client fails to meet contractual obligations, prompting the bank to pay on the client's behalf. while both build trust by acting as a financial guarantee for borrowers, a bank guarantee is often used within real estate and infrastructure contracts. the primary characteristic that differentiates a bank guarantee from a letter. What Is Bank Guarantee Vs Letter Of Credit.

From www.vrogue.co

Bank Guarantee Vs Letter Of Credit Examples And Diffe vrogue.co What Is Bank Guarantee Vs Letter Of Credit bank guarantees and letters of credit ensure that both parties receive the decided payments. A letter of credit, both letters of credit and bank guarantees function very similarly. while both build trust by acting as a financial guarantee for borrowers, a bank guarantee is often used within real estate and infrastructure contracts. Both a bank guarantee and a. What Is Bank Guarantee Vs Letter Of Credit.

From www.youtube.com

letter of credit vs bank guarantee letter of credit bank credit What Is Bank Guarantee Vs Letter Of Credit A letter of credit, both letters of credit and bank guarantees function very similarly. bank guarantees and letters of credit ensure that both parties receive the decided payments. the primary characteristic that differentiates a bank guarantee from a letter of credit is that it is used for more than just essential trade. when it comes to a. What Is Bank Guarantee Vs Letter Of Credit.

From www.congress-intercultural.eu

Bank Guarantee Letter Of Credit What's The Difference?, 45 OFF What Is Bank Guarantee Vs Letter Of Credit while both build trust by acting as a financial guarantee for borrowers, a bank guarantee is often used within real estate and infrastructure contracts. a bank guarantee is activated when the client fails to meet contractual obligations, prompting the bank to pay on the client's behalf. Both a bank guarantee and a letter of credit are a commitment. What Is Bank Guarantee Vs Letter Of Credit.

From differbtw.com

Difference Between Letter of Credit and Bank Guarantee Differ Between What Is Bank Guarantee Vs Letter Of Credit what is the difference between a letter of credit and a bank guarantee? a letter of credit ensures that the amount will be paid as long as the services are performed in a defined manner. Both a bank guarantee and a letter of credit are a commitment from a. a bank guarantee is activated when the client. What Is Bank Guarantee Vs Letter Of Credit.

From issuu.com

Bank Guarantee vs. Letter of Credit How do they differ? by dgftguru What Is Bank Guarantee Vs Letter Of Credit when it comes to a bank guarantee vs. A letter of credit, both letters of credit and bank guarantees function very similarly. the primary characteristic that differentiates a bank guarantee from a letter of credit is that it is used for more than just essential trade. a letter of credit ensures that the amount will be paid. What Is Bank Guarantee Vs Letter Of Credit.

From www.diffzy.com

Letter of Credit vs. Bank Guarantee What's The Difference (With Table) What Is Bank Guarantee Vs Letter Of Credit the primary characteristic that differentiates a bank guarantee from a letter of credit is that it is used for more than just essential trade. what is the difference between a letter of credit and a bank guarantee? a bank guarantee is activated when the client fails to meet contractual obligations, prompting the bank to pay on the. What Is Bank Guarantee Vs Letter Of Credit.

From tazapay.com

Letter of Credit vs. Bank Guarantee Clearing the Confusion Tazapay What Is Bank Guarantee Vs Letter Of Credit Both a bank guarantee and a letter of credit are a commitment from a. A letter of credit, both letters of credit and bank guarantees function very similarly. the primary characteristic that differentiates a bank guarantee from a letter of credit is that it is used for more than just essential trade. a bank guarantee is activated when. What Is Bank Guarantee Vs Letter Of Credit.

From www.bondexchange.com

Surety Bonds vs. Letters of Credit The Ultimate Guide What Is Bank Guarantee Vs Letter Of Credit A letter of credit, both letters of credit and bank guarantees function very similarly. Both a bank guarantee and a letter of credit are a commitment from a. bank guarantees and letters of credit ensure that both parties receive the decided payments. what is the difference between a letter of credit and a bank guarantee? a letter. What Is Bank Guarantee Vs Letter Of Credit.